|

|

|

|

Research

Interests :

|

My current interests span Mathematical Finance, Financial

Engineering and Actuarial Science. In particular, I have been

working on topics including:

- High frequency algorithmic trading

- Applied stochastic control in Finance

- Mean-Field Games with Financial Applications

- Machine learning in finance

- Commodity Modeling and Derivative Valuation

- Homogenization and Singular Perturbation in Finance and

Insurance

- Real Options

- Valuation of financial linked insurance products

You can find links to my published and working papers

below. |

Colleagues and Students :

The Mathematical Finance/Actuarial Science research group in the

Department of Statistics consists of four professors :

Prof. A.

Badescu, Prof. S. Broverman,

Prof. S.

Jaimungal, and Prof. X. S. Lin

and several Ph.D. students.

Here is a list of my current students and their research

interests:

| Student |

Research Topic |

| Zhen Qin |

Commodity Models and Ambiguity Aversion |

| David Farahany |

Monte Carlo-PDE nethods for Option Valuation |

| Tianyi Jia |

FX markets and trading |

| Luhui (Luke) Gan |

Algorithmic Trading |

| Xuancheng (Bill) Huang |

Mean Field Games |

| Ali Al-Aradi |

Stochastic Portfolio Theory |

| Philippe Casgrain |

Partial Information in Algorithmic Trading |

Here is a list of our current Post Docs and their research

interests:

| Post Docs |

Research Topic |

| Omid Namvar Gharehshiran |

Reinforcement learning in algorithmic trading |

Here are my former Ph.D. Student's theses:

|

|

|

The FST Methods

The FST, mrFST and irFST method, developed in collaboration with K. Jackson

and V. Surkov, for valuing a variety of options allows for efficient

computation of path-dependent options for equities, commodities, and interest

rate derivatives. The underlying dynamics is based on Levy models with and

without regime changes and with and without mean-reversion. You can find the

relevant research papers below. Matlab source code can also be found here: http://fst-framework.sourceforge.net/

Publications and Working Papers

[Below you will find my working papers and publications.]

Algorithmic

and High Frequency Trading, with Álvaro Cartea and Jose Penalva,

Cambridge University Press, now available!

Order here from CUP

Order here from Amazon.co.uk

Order here from Amazon.com

Click here for the book

website where you can find data, code and other materials related

to the book.

Portfolio Liquidation and Ambiguity Aversion [ PDF] with Álvaro Cartea and Ryan Donnelly

We consider an optimal execution problem where an agent holds a position in an asset which must be liquidated (using limit orders) before a terminal horizon. Beginning with a standard model for the trading dynamics, we analyse how the acknowledgement of model misspecification affects the agent's optimal trading strategy. The three possible sources of misspecification in this context are: (i) the arrival rate of market orders, (ii) the fill probability of limit orders, and (iii) the dynamics of the asset price. We show that ambiguity aversion with respect to each factor of the model has a similar effect on the optimal strategy, but the magnitude of the effect depends on time and inventory position in different ways depending on the source of uncertainty. In addition we allow the agent to employ market orders to further increase the strategy's profitability and show the effect of ambiguity aversion on the shape of the optimal impulse region. In some cases we have a closed-form expression for the optimal trading strategy which significantly enhances the efficiency in which the strategy can be executed in real time.

Hedge and Speculate: replicating option payoffs with limit and market orders [ PDF] with Álvaro Cartea and Luhui Gan

We consider an agent who takes a short position in a contingent claim and employs limit orders (LOs) and market orders (MOs) to trade in the underlying asset to maximize expected utility of terminal wealth. The agent solves a combined optimal stopping and control problem where trading has frictions: MOs (executed by the agent and other traders) have permanent price impact and pay exchange fees, and LOs earn the spread (relative to the midprice of the asset) and pay no exchange fees. We show how the agent replicates the payoff of the claim and also speculates in the asset to maximize expected utility of terminal wealth. In the strategy, MOs are used to keep the inventory on target, to replicate the payoff, and LOs are employed to build the inventory at favorable prices and boost expected terminal wealth by executing roundtrip trades that earn the spread. We calibrate the model to the E-mini contract that tracks the S\&P500 index, provide numerical examples of the performance of the strategy, and proof that our scheme converges to the viscosity solution of the dynamic programming equation.

Beating the Market: Dynamic Asset Allocation with a Market Portfolio Benchmark [ PDF] with Ali Al-Aradi

Beating the market portfolio is a problem faced by many investors. Here, we formulate and solve a dynamic allocation problem that maximizes the

utility of relative wealth of the investor's portfolio to that of the market portfolio. We also allow the investor to control the deviation of the optimal

allocation from the market portfolio itself, and using stochastic control techniques, provide explicit closed form expressions for the optimal allocation.

In addition, we demonstrate how the optimal portfolio can be factored into five passive rule-based portfolios: (i) global minimum variance portfolio;

(ii) high-growth portfolio; (iii) high-cash-flow portfolio; (iv) equal-weight portfolio; and (v) risk-parity portfolio. Finally, some numerical experiments

based on calibration to real-world data are presented to illustrate the risk-reward profile of the optimal allocation in comparison to these and other commonly used strategies.

Trading algorithms with learning in latent alpha models [ PDF ] with Philippe Casgrain

Alpha signals for statistical arbitrage strategies are often driven by latent factors. This paper analyses how to optimally trade with latent factors that cause prices to jump and diffuse. Moreover, we account for the effect of the trader's actions on quoted prices and the prices they receive from trading. Under fairly general assumptions, we demonstrate how the trader can learn the posterior distribution over the latent states, and explicitly solve the latent optimal trading problem. To illustrate the efficacy of the optimal strategy, we demonstrate its performance through simulations and compare it to strategies which ignore learning in the latent factors.

Mixing LSMC and PDE Methods to Price Bermudan Options [ PDF with David Farahany and Ken Jackson

We develop a mixed least square Monte Carlo-partial differential equation (LSMC-PDE) method for pricing Bermudan style options with assets whose dynamics are driven by latent variables. The algorithm is formulated for an arbitrary number of assets and volatility processes, and its probabilistic convergence is established. Our numerical examples focus on the Heston model and we compare our hybrid algorithm with a full LSMC approach. Using Fourier methods we are able to derive efficient FFT based solutions, and we demonstrate that our algorithm greatly reduces the variance in the computed prices and optimal exercise boundaries. We also compare the early exercise boundaries and prices computed by our hybrid algorithm with those produced by �finite difference methods and �find excellent agreement.

Speculative Trading of Electricity Contracts in Interconnected Locations [ PDF ] with Álvaro Cartea and Zhen Qin

We derive an investor's optimal trading strategy of electricity contracts traded in two locations joined by an interconnector. The investor employs a price model which includes the impact of her own trades. The investor's trades have a permanent impact on prices because her trading activity affects the demand of contracts in both locations. Additionally, the investor receives prices which are worse than the quoted prices as a result of the elasticity of liquidity provision of contracts. Furthermore, the investor is ambiguity averse, so she acknowledges that her model of prices may be misspecified and considers other models when devising her trading strategy. We show that as the investor's degree of ambiguity aversion increases, her trading activity decreases in both locations, and thus her inventory exposure also decreases. Finally, we show that there is a range of ambiguity aversion parameters where the Sharpe ratio of the trading strategy increases when ambiguity aversion increases.

Liquidating Baskets of Co-Moving Assets[

PDF ] with Álvaro Cartea and Luhui

Gan

We show how to execute a basket consisting of a subset of

co-moving assets and demonstrate how the information carried in other traded

assets, which are not in the basket, improves execution performance. Market

orders (MOs) from all participants, including the agent's orders to execute her

basket, have permanent price impact on the assets, i.e. executions in a single

asset affect prices of all assets. Furthermore, we assume the agent's MOs are

executed at worse than midprices (by walking the LOB) through a temporary price

impact. The execution problem is posed as an optimal stochastic control one and

we reduce the dynamic programming equation to a system of coupled partial

differential equations, which reduces to a coupled system of Riccati equations

when other agents' order flow are deterministic. We use data of five stocks

traded in the Nasdaq exchange to estimate the model parameters and use

simulations to illustrate the performance of the strategy. As an example, the

agent liquidates a portfolio consisting of shares in INTC and SMH. We show that

including the information provided by three additional assets (FARO, NTAP,

ORCL) considerably improves the strategy's performance -- for the portfolio we

execute, it outperforms the multi-asset version of Almgren-Chriss by

approximately 2 to 4 basis points per share.

Enhancing Trading Strategies using Order Book Signals [ PDF ] with Álvaro Cartea and Ryan

Donnelly

We use high-frequency data from the Nasdaq exchange to build

a measure of volume order imbalance in the limit order book (LOB). We show that

our measure is a good predictor of the sign of the next market order (MO), i.e.

buy or sell, and also helps to predict price changes immediately after the

arrival of an MO. Based on these empirical findings, we introduce and calibrate

a Markov chain modulated pure jump model of price, spread, LO and MO arrivals,

and order imbalance. As an application of the model, we pose and solve a

stochastic control problem for an agent who maximizes terminal wealth, subject

to inventory penalties, by executing roundtrip trades using LOs. We use

in-sample-data (January to June 2014) to calibrate the model to ten equities

traded in the Nasdaq exchange, and use out-of-sample data (July to December

2014) to test the performance of the strategy. We show that introducing our

volume imbalance measure into the optimisation problem considerably boosts the

profits of the strategy. Profits increase because employing our imbalance

measure reduces adverse selection costs and positions LOs in the book to take

advantage of favorable price movements.

Trading Strategies within the Edges of No-Arbitrage [ PDF ] with Álvaro Cartea and Jason

Ricci

We develop a trading strategy which employs limit and market

orders in a multi-asset economy where the assets are not only correlated, but

can also be structurally dependent. To model the structural dependence, the

midprice processes follow a multivariate reflected Brownian motion on the

closure of a no-arbitrage region which is dictated by the assets' bid-ask

spreads. We provide a formal framework for such an economy and solve for the

value function and optimal control for an investor who takes positions in these

assets. The optimal strategy exhibits two dominant features which depend on how

far the vector of midprices is from the no-arbitrage bounds. When midprices are

sufficiently far from the no-arbitrage edges, the strategy behaves as that of a

market maker who posts buy and sell limit orders. And when the midprice vector

is close to the edge of the no-arbitrage region, the strategy executes a

combination of market orders and limit orders to profit from statistical

arbitrages. Moreover, we discuss a numerical scheme to solve for the value

function and optimal control, and perform a simulation study to discuss the

main characteristics of the optimal strategy.

Algorithmic Trading of Co-Integrated Assets [ PDF ] with Álvaro Cartea,

Int. J. Theoretical and Applied Finance, Forthcoming

We assume that the drift in the returns of asset prices

consists of an idiosyncratic component and a common component given by a

co-integration factor. We analyze the optimal investment strategy for an agent

who maximizes expected utility of wealth by dynamically trading in these

assets. The optimal solution is constructed explicitly in closed-form and is

shown to be affine in the co-integration factor. We calibrate the model to

three assets traded on the Nasdaq exchange (Google, Facebook, and Amazon) and

employ simulations to showcase the strategy's performance.

Foreign Exchange Markets with Last Look [ PDF ] with Álvaro Cartea

We examine the Foreign Exchange (FX) spot price spreads with

and without Last Look on the transaction. We assume that brokers are

risk-neutral and they quote spreads so that losses to latency arbitrageurs

(LAs) are recovered from other traders in the FX market. These losses are

reduced if the broker can reject, ex-post, loss-making trades by enforcing the

Last Look option which is a feature of some trading venues in FX markets. For a

given rejection threshold the risk-neutral broker quotes a spread to the market

so that her expected profits are zero. When there is only one venue, we find

that the Last Look option reduces quoted spreads. However, if there are two

venues we show that the market reaches an equilibrium where traders have no

incentive to migrate. The equilibrium can be reached with both venues

coexisting, or with only one venue surviving. Moreover, when one venue enforces

Last Look and the other one does not, counterintuitively, it may be the case

that the Last Look venue quotes larger spreads.

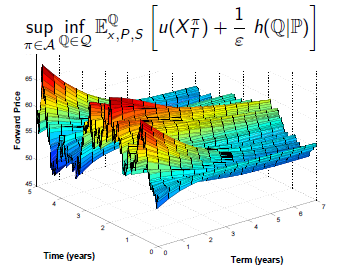

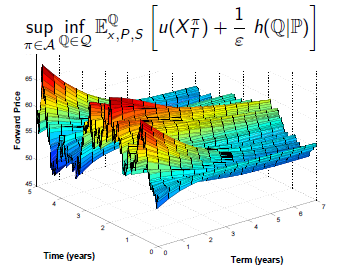

Model Uncertainty in Commodity Markets [ PDF ] with Álvaro Cartea and Zhen

Qin, SIAM Journal of Financial Mathematics, Forthcoming

Agents who acknowledge that their models are incorrectly

specified are said to be ambiguity averse, and this affects the prices they are

willing to trade at. Models for prices of commodities attempt to capture three

stylized features: seasonal trend, moderate deviations (a diffusive factor) and

large deviations (a jump factor) both of which mean-revert to the seasonal

trend. Here we model ambiguity by allowing the agent to consider a class of

models absolutely continuous w.r.t. their reference model, but penalize

candidate models that are far from it. The buyer (seller) of a forward contract

introduces a negative (positive) drift in the dynamics of the spot price, and

enhances downward (upward) jumps so the prices they are willing to trade at are

lower (higher) than that of the forward price under P. When ambiguity averse

buyers and sellers employ the same reference measure they cannot trade because

the seller requires more than what the buyer is willing to pay. Finally, we

observe that when ambiguity averse agents price options written on the

commodity forward, the effect of ambiguity aversion is strongest when the

option is at-the-money, and weaker when it is deep in-the-money or deep

out-of-the-money.

Irreversible Investments and Ambiguity Aversion [ PDF ] with Álvaro Cartea

Real-option valuation traditionally is concerned with

investment under conditions of project-value uncertainty, while assuming that

the agent has perfect confidence in a specific model. However, agents generally

do not have perfect confidence in their models, and this ambiguity affects

their decisions. Moreover, real investments are not spanned by tradable assets

and generate inherently incomplete markets. In this work, we account for an

agent's aversion to model ambiguity and address market incompleteness through

the notation of robust indifference prices. We derive analytical results for

the perpetual option to invest and the linear complementarity problem that the

finite time problem satisfies. We find that ambiguity aversion has dual effects

that are similar to, but distinct from, those of risk aversion. In particular,

agents are found to exercise options earlier or later than their

ambiguity-neutral counterparts, depending on whether the ambiguity stems from

uncertainty in the investment or in a hedging asset.

Mean-Field Game Strategies for Optimal Execution [PDF ] with

Bill Huang and Mojtaba Nourian

Algorithmic trading strategies for execution often focus on the individual agent who is liquidating/acquiring shares. When generalized to multiple agents, the resulting stochastic game is notoriously difficult to solve in closed-form. Here, we circumvent the difficulties by investigating a mean-field game framework containing (i) a major agent who is liquidating a large number of shares, (ii) a number of minor agents (high-frequency traders (HFTs)) who detect and trade against the liquidator, and (iii) noise traders who buy and sell for exogenous reasons. Our setup accounts for permanent price impact stemming from all trader types inducing an interaction between major and minor agents. Both optimizing agents trade against noise traders as well as one another. This stochastic dynamic game contains couplings in the price and trade dynamics, and we use a mean-field game approach to solve the problem. We obtain a set of decentralized feedback trading strategies for the major and minor agents, and express the solution explicitly in terms of a deterministic fixed point problem. For a finite $N$ population of HFTs, the set of major-minor agent mean-field game strategies is shown to have an $\epsilon_N$-Nash equilibrium property where $\epsilon_N\to0$ as $N\to\infty$.

Incorporating Order-Flow into Optimal Execution [ PDF ] with Álvaro Cartea,

Mathematics and Financial Economics, Forthcoming

We provide an explicit closed-form strategy for an investor who executes a

large order when market order-flow from all agents, including the investor's

own trades, has a permanent price impact. The strategy is found in closed-form

when the permanent and temporary price impacts are linear in the market's and

investor's rates of trading. We do this under very general assumptions about

the stochastic process followed by the order-flow of the market. The optimal

strategy consists of an Almgren-Chriss execution strategy adjusted by a

weighted-average of the future expected net order-flow (given by the difference

of the market's rate of buy and sell market orders) over the execution trading

horizon and proportional to the ratio of permanent to temporary linear impacts.

We use historical data to calibrate the model to five Nasdaq traded stocks

(FARO, SMH, NTAP, ORCL, INTC) and use simulations to show how the strategy

performs.

Order-Flow and Liquidity Provision [ PDF ] with Álvaro Cartea

We show how to optimally take positions in the limit order book by placing

limit orders at-the-touch when the midprice of the asset is affected by the

trading activity of the market. The midprice dynamics have a short-term-alpha

component which reflects how instantaneous net order-flow, the difference

between the number of market buy and market sell orders, affects the asset's

drift. If net-order flow is positive (negative), so short-term-alpha is

positive (negative), the strategy may even withdraw from the sell (buy) side of

the limit order book to take advantage of inventory appreciation (depreciation)

and to protect the trading strategy from adverse selection costs.

A Closed-Form Execution Strategy to Target VWAP [ PDF ] with Álvaro Cartea, SIAM J. Financial Mathematics, Forthcoming

We provide two explicit closed-form optimal execution strategies to target

VWAP. We do this under very general assumptions about the stochastic process

followed by the volume traded in the market, and the agent's orders have both

temporary and permanent impact on the midprice. The strategies that target VWAP

are found in closed-form. One strategy consists of TWAP adjusted upward by a

fraction of instantaneous order-flow and adjusted downward by the average

order-flow that is expected over the remaining life of the strategy. The other

strategy consists of the Almgren-Chriss execution strategy adjusted by the

expected volume and net order-flow during the remaining life of the strategy.

We calibrate model parameters to five stocks traded in Nasdaq (FARO, SMH, NTAP,

ORCL, INTC) and use simulations to show that the strategies target VWAP very

closely and on average outperform the target by between 0.10 and 8 basis

points.

Optimal Execution with Limit and Market Orders [ PDF ] with Álvaro Cartea,

Quantitative Finance, Vol. 15, No. 8, 1279–1291

We develop an optimal execution policy for an investor seeking to execute a

large order using limit and market orders. The investor solves the optimal

policy considering different restrictions on volume of both types of orders and

depth at which limit orders are posted. As a particular example we show how the

execution policies perform when targeting the volume schedule of the

time-weighted-average-price (TWAP). The different strategies considered by the

investor always outperform TWAP with an average savings per share of about two

to three times the spread. This improvement over TWAP is due to the strategies

benefiting from the optimal mix of limit orders, which earn the spread, and

market orders, which keep the investor's inventory schedule on target.

How to Value a Gas Storage Facility [ PDF ] with Álvaro Cartea and James

Cheeseman, Chapter in

Handbook of Multi-Commodity Markets and Products: Structuring, Trading and Risk

Management, (The Wiley Finance Series)

We show how to value a storage facility using

Least Squares Monte Carlo (LSMC). We present a toy model to understand how to

employ the LSMC algorithm and then show how to incorporate realistic

constraints in the valuation including: the maximum capacity of the storage,

injection and withdrawal rates and costs, and market constraints such as

bid-ask spread in the spot market and transaction costs.

Algorithmic Trading with Learning [ PDF ] with Álvaro Cartea and Damir

Kinzebulatov, Int. J. Theoretical and Applied Finance, Forthcoming

We propose a model where an algorithmic trader

takes a view on the distribution of prices at a future date and then decides

how to trade in the direction of her predictions using the optimal mix of

market and limit orders. As time goes by, the trader learns from changes in

prices and updates her predictions to tweak her strategy. Compared to a trader

that cannot learn from market dynamics or form a view of the market, the

algorithmic trader's profits are higher and more certain. Even though the

trader executes a strategy based on a directional view, the sources of profits

are both from making the spread as well as capital appreciation of inventories.

Higher volatility of prices considerably impairs the trader's ability to learn

from price innovations, but this adverse effect can be circumvented by learning

from a collection of assets that co-move.

Optimal Accelerated Share Repurchases [ PDF ] with Damir Kinzebulatov and

Dmitri H. Rubisov

An accelerated share repurchase (ASR) allows a firm to

repurchase a significant portion of its shares immediately, while shifting the

burden of reducing the impact and uncertainty in the trade to an intermediary.

The intermediary must then purchase the shares from the market over several

days, weeks, or as much as several months. Some contracts allow the

intermediary to specify when the repurchase ends, at which point the

corporation and the intermediary exchange the difference between the arrival

price and the TWAP over the trading period plus a spread. Hence, the

intermediary effectively has an American option embedded within an optimal

execution problem. As a result, the firm receives a discounted spread relative

to the no early exercise case. In this work, we address the intermediary's

optimal execution and exit strategy taking into account the impact that trading

has on the market. We demonstrate that it is optimal to exercise when the TWAP

exceeds \zeta(t) S_t where S_t is the fundamental price of the asset and

\zeta(t) is deterministic. Moreover, we develop a dimensional reduction of the

stochastic control and stopping problem and implement an efficient numerical

scheme to compute the optimal trading and exit strategies.

Algorithmic Trading with Model Uncertainty [ PDF ] with Álvaro Cartea and Ryan

Donnelly, SIAM Financial Mathematics, Forthcoming

Because algorithmic traders acknowledge that their models are incorrectly

specified we allow for ambiguity in their choices to make their models robust

to misspecification. We show how to include misspecification to: (i) the

arrival rate of market orders (MOs), (ii) the fill probability of limit orders,

and (iii) the dynamics of the midprice of the asset they trade. In the context

of market making, we demonstrate that market makers (MMs) adjust their quotes

to reduce inventory risk and adverse selection costs. Moreover, robust market

making increases the strategy's Sharpe ratio and allows the MM to fine tune the

tradeoff between the mean and the standard deviation of profits. Our framework

adopts a robust optimal control approach and we provide existence and

uniqueness results for the robust optimal strategies as well as a verification

theorem. The behavior of the ambiguity averse MM generalizes that of a risk

averse MM, and coincide in only one circumstance.

A real options model to evaluate the effect of environmental

policies on the oil sands rate of expansion [ PDF ] with Laleh Kobari and Yuri

Lawryshyn, Energy Economics, Volume 45, September 2014, Pages

155-165

Canadian oil sands hold the third largest recognized oil

deposit in the world. While the rapidly expanding oil sands industry in western

Canada has driven economic growth, the extraction of the oil comes at a

significant environmental cost. It is believed that the government policies

have failed to keep up with the rapid oil sands expansion, creating serious

challenges in managing the environmental impacts. This paper presents a

practical, yet financially sound, real options model to evaluate the rate of

oil sands expansion, under different environmental cost scenarios resulting

from governmental policies, while accounting for oil price uncertainty and

managerial flexibilities. Our model considers a multi-plant/multi-agent

setting, in which labor costs increase for all agents and impact their optimal

strategies, as new plants come online. Our results show that a stricter

environmental cost scenario delays investment, but leads to a higher rate of

expansion once investment begins. Once constructed, a plant is highly unlikely

to shut down. Our model can be used by government policy makers, to gauge the

impact of policy strategies on the oil sands expansion rate, and by oil

companies, to evaluate expansion strategies based on assumptions regarding

market and taxation costs.

Optimal Execution with a Price Limiter [ PDF ] with Damir Kinzebulatov,

RISK, July 2014

Agents often wish to limit the price they pay for an asset.

If they are acquiring a large number of shares, they must balance the risk of

trading slowly (to limit price impact) with the risk of future uncertainty in

prices. Here, we address the optimal acquisition problem for an agent who is

unwilling to pay more than a specified price for an asset while they are

subject to market impact and price uncertainty. The problem is posed as an

optimal stochastic control and we provide an analytical closed form solution

for the perpetual case as well as a dimensional reduced PDE for the general

case. The optimal seed of trading is found to no longer be deterministic and

instead depends on the fundamental price of the asset. Moreover, we demonstrate

that a price limiter constraint significantly reduces the conditional tail

expectation of the securities costs.

Risk Metrics and Fine Tuning of High Frequency Trading

Strategies[ PDF ] with

Álvaro Cartea, Mathematical Finance, Vol. 25(3), 576-611

We propose risk measures to assess the performance of High Frequency (HF)

trading strategies that seek to maximize profits from making the realized

spread where the holding period is extremely short (fractions of a second,

seconds or at most minutes). The HF trader is risk-neutral and maximizes

expected terminal wealth but is constrained by both capital and the amount of

inventory that she can hold at any time. The risk measures enable the HF trader

to fine tune her strategies by trading off different measures of inventory

risk, which also proxy for capital risk, against expected profits. The dynamics

of the midprice of the asset are driven by information flows which are

impounded in the midprice by market participants who update their quotes in the

limit order book. Furthermore, the midprice also exhibits stochastic jumps as a

consequence of the arrival of market orders that have an impact on prices which

can give rise to market momentum (expected prices to trend up or down).

Valuing GWBs with Stochastic Interest Rates and Volatility

[ PDF ] with Dmitri Rubisov and

Ryan Donnelly, Quantitative Finance, 14(2) pg. 369-382

Guaranteed withdrawal benefits (GWBs) are long term

contracts which provide investors with equity participation while guaranteeing

them a secured income stream. Due to the long investment horizons involved,

stochastic volatility and stochastic interest rates are important factors to

include in their valuation. Moreover, investors are typically allowed to

participate in a mixed fund composed of both equity and fixed-income

securities. Here, we develop an efficient method for valuing these

path-dependent products through re-writing the problem in the form of an Asian

styled claim and a dimensionally reduced PDE. The PDE is then solved using an

Alternating Direction Implicit (ADI) method. Furthermore, we derive an

analytical closed form approximation and compare this approximation with the

PDE results and find excellent agreement. We illustrate the various effects of

the parameters on the valuation through numerical experiments and discuss their

financial implications.

Buy Low Sell High: A High Frequency Trading Perspective [

PDF ] with Álvaro Cartea and

Jason Ricci, SIAM Journal of Financial Mathematics, 5.1 (2014):

415-444.

We develop a High Frequency (HF) trading strategy where the

HF trader uses her superior speed to process information and to post limit sell

and buy orders. We introduce a multi-factor self-exciting process which allows

for feedback effects in market buy and sell orders and the shape of the limit

order book (LOB). The model accounts for arrival of market orders that

influence activity, trigger one-sided and two-sided clustering of trades, and

induce temporary changes in the shape of the LOB. The resulting strategy

outperforms the Poisson strategy where the trader does not distinguish between

influential and non-influential events.

The Generalized Shiryaev's Problem and Skorohod Embedding [

PDF ] with Alex Kreinin and Angel

Valov,Theory Probab. Appl., 58(3), 493–502

In this paper we consider a connection between the famous

Skorohod embedding problem and the Shiryaev inverse problem for the first

hitting time distribution of a Brownian motion: given a probability

distribution, F, find a boundary such that the first hitting time distribution

is F. By randomizing the initial state of the process we show that the inverse

problem becomes analytically tractable. The randomization of the initial state

allows us to significantly extend the class of target distributions in the case

of a linear boundary and moreover allows us to establish connection with the

Skorohod embedding problem.

Valuing Clustering in Catastrophe Derivatives [ PDF ] with Yuxiang Chong,

Quantitive Finance, 14(2) pg. 259-270

The role that clustering in activity and/or severity plays

in catastrophe modeling and derivative valuation is a key aspect that has been

overlooked in the recent literature. Here, we propose two marked point

processes to account for these features. The first approach assumes the points

are driven by a stochastic hazard rate modulated by a Markov chain while marks

are drawn from a regime specific distribution. In the second approach, the

points are driven by a self-exciting process while marks are drawn from a fixed

distribution. Within this context, we provide a unified approach to efficiently

value catastrophe options -- such as those embedded in catastrophe bonds -- and

show that our results are within the 95% confidence interval computed using

Monte Carlo simulations. Our approach is based on deriving the valuation PIDE

and utilizes transforms to provide semi-analytical closed form solutions. This

contrasts with most prior works where the valuation formulae require computing

several infinite sums together with numerical integration.

Incorporating Managerial Information into Real Option

Valuation [ PDF ] with

Yuri Lawryshyn, Commodities, Energy and Environmental Finance, vol.

74,chap. Incorporating Managerial Information into Real Option

Valuation, pp. 213–238.Springer (2015)

Real options analysis (ROA) is widely recognized as a

superior method for valuing projects with managerial flexibilities. Yet, its

adoption remains limited due to varied difficulties in its implementation. In

this work, we propose a real options approach that utilizes managerial

cash-flow estimates to value early stage project investments. By introducing a

sector indicator process which drives the project-value we are able to match

arbitrary managerial cash-flow distributions. This sector indicator allows us

to value managerial flexibilities and obtain hedges in an easy to implement

manner. Our approach to ROA is consistent with financial theory, requires

minimal subjective input of model parameters, and bridges the gap between

theoretical ROA frameworks and practice.

Modeling Asset Prices for Algorithmic and High Frequency

Trading [ PDF ] with

Álvaro Cartea, Applied Mathematical Finance, 20 (6) pg. 512-547

Algorithmic Trading (AT) and High Frequency (HF) trading,

which are responsible for over 70% of US stocks trading volume, have greatly

changed the microstructure dynamics of tick-by-tick stock data. In this paper

we employ a hidden Markov model to examine how the intra-day dynamics of the

stock market have changed, and how to use this information to develop trading

strategies at ultra-high frequencies. In particular, we show how to employ our

model to submit limit-orders to profit from the bid-ask spread and we also

provide evidence of how HF traders may profit from liquidity incentives

(liquidity rebates). We use data from February 2001 and February 2008 to show

that while in 2001 the intra-day states with shortest average durations were

also the ones with very few trades, in February 2008 the vast majority of

trades took place in the states with shortest average durations. Moreover, in

2008 the fastest states have the smallest price impact as measured by the

volatility of price innovations.

Real Option Valuation with Uncertain Costs [ PDF ]

with Max O. de Souza and Jorge P. Zubelli. Euro Journal of Finance, 19

(7-8) pg. 625-644

In this work we are concerned with valuing the option to

invest in a project when the project value and the investment cost are both

mean-reverting. Previous works on stochastic project and investment cost

concentrate on geometric Brownian motions (GBMs) for driving the factors.

However, when the project involved is linked to commodities, mean-reverting

assumptions are more meaningful. Here, we introduce a model and prove that the

optimal exercise strategy is not a function of the ratio of the project value

to the investment V/I -- contrary to the GBM case. We also demonstrate that the

limiting trigger curve as maturity approaches traces out a non-linear curve in

the (V,I) plan and derive its explicit form. Finally, we numerically

investigate the finite-horizon problem using the Fourier space time-stepping

algorithm of Jaimungal & Surkov (2009). Numerically, the optimal exercise

policies are found to be approximately linear in V/I; however, contrary to the

GBM case they are not described by a curve of the form V*/I* = c(t). The option

price behavior as well as the trigger curve behavior nicely generalize earlier

one-factor model results.

Spectral Decomposition of Option Prices in Fast Mean-Reverting

Stochastic Volatility Models [ PDF ] with Jean-Pierre Fouque and

Matthew Lorig. SIAM Journal of Financial Mathematics (2) pp. 665-691

(2015)

Using spectral decomposition techniques and singular

perturbation theory, we develop a systematic method to approximate the prices

of a variety of options in a fast mean-reverting stochastic volatility setting.

Four examples are provided in order to demonstrate the versatility of our

method. These include: European options, up-and-out options, double-barrier

knock-out options, and options which pay a rebate upon hitting a boundary. For

European options, our method is shown to produce option price approximations

which are equivalent to those developed in Fouque, Papanicolaou, and Sircar

(2000).

Valuing Early Exercise Interest Rate Options with Multi-Factor

Affine Models [ PDF ][ Matlab ] with Vladimir Surkov.

Int. J. Theor. Appl. Finan. 16, 1350034 (2013)

Multi-factor interest rate models are widely used in

practice. Quite often, contingent claims with earlier exercise features are

valued by resorting to trees, finite-difference schemes and Monte Carlo

simulations. However, when jumps are present these methods are less accurate

and/or efficient. In this work we develop an algorithm based on a sequence of

measure changes coupled with Fourier transform solutions of the pricing

partial-integro differential equation to solve the pricing problem. The method,

coined the irFST method, also neatly computes option sensitivities.

Furthermore, we develop closed form formulae for accrual swaps and accrual

range notes under our multi-factor jump-diffusion model. We demonstrate the

versatility and precision of the method through numerical experiments on

European, Bermudan and callable bond options, (accrual) swaps and range

notes.

Randomized First Passage Times [ PDF ] with Alex Kreinin and Angelo

Valov.

In this article we study a problem related to the first

passage and inverse first passage time problems for Brownian motions originally

formulated by Jackson, Kreinin and Zhang (2009). Specifically, define $\tau_X =

\inf\{t>0:W_t + X \le b(t) \}$ where $W_t$ is a standard Brownian motion,

then given a boundary function $b:[0,\infty) \to \RR$ and a target measure

$\mu$ on $[0,\infty)$, we seek the random variable $X$ such that the law of

$\tau_X$ is given by $\mu$. We characterize the solutions, prove uniqueness and

existence and provide several key examples associated with the linear boundary.

Kernel-Based Copula Processes [ PDF ]

with Eddie K.H. Ng, ECML-PKDD 2009, LNAI 5781, pp. 628-643, 2009.

Kernel-based Copula Processes (KCPs), a new versatile tool

for analyzing multiple time-series, are proposed here as a unifying framework

to model the interdependency across multiple time-series and the long-range

dependency within an individual time-series. KCPs build on the celebrated

theory of copula which allows for the modeling of complex interdependence

structure, while leveraging the power of kernel methods for efficient learning

and parsimonious model specification. Specifically, KCPs can be viewed as a

generalization of the Gaussian processes enabling non-Gaussian predictions to

be made. Such non Gaussian features are extremely important in a variety of

application areas. As one application, we consider temperature series from

weather stations across the US. Not only are KCPs found to have modeled the

heteroskedasticity of the individual temperature changes well, the KCPs also

successfully discovered the interdependencies among different stations. Such

results are beneficial for weather derivatives trading and risk management, for

example.

Incorporating Risk Aversion and Model

Misspecification into a Hybrid Model of Default [ PDF ]

with G. Sigloch. Mathematical Finance, Vol. 22 (1), pp. 57-81, 2012

It is well known that purely structural models of default

cannot explain short term credit spreads, while purely intensity based models

of default lead to completely unpredictable default events. Here we introduce a

hybrid model of default in which a firm enters distress upon a non-tradable

credit worthiness index (CWI) hitting a critical level. Upon distress, the firm

defaults at the next arrival of a Poisson process. To value defaultable bonds

and CDSs we introduce the concept of robust indifference pricing which differs

from the usual indifference valuation paradigm by the inclusion of model

uncertainty. To account for model uncertainty, the embedded optimization

problems are modified to include a minimization over a set of candidate

measures equivalent to the estimated reference measure. With this new model and

pricing paradigm, we succeed in determining corporate bond spreads and CDS

spreads and find that model uncertainty plays a similar, but distinct, role to

risk aversion. In particular, model uncertainty allows for significant short

term spreads.

Integral Equations and the First Passage Time of

Brownian Motions [ PDF ]

with A. Kreinin and A. Valov.

The first passage time problem for Brownian motions hitting

a barrier has been extensively studied in the literature. In particular, many

incarnations of integral equations which link the density of the hitting time

to the equation for the barrier itself have appeared. Most interestingly,

Peskir(2002b) demonstrates that a master integral equation can be used to

generate a countable number of new equations via differentiation or integration

by parts. In this article, we generalize Peskir's results and provide a more

powerful unifying framework for generating integral equations through a new

class of martingales. We obtain a continuum of Volterra type integral equations

of the first kind and prove uniqueness for a subclass. Furthermore, through the

integral equations, we demonstrate how certain functional transforms of the

boundary affect the density function. Finally, we demonstrate a fundamental

connection between the Volterra integral equations and a class of Fredholm

integral equations.

An Insurance Risk Model with Stochastic

Volatility [ PDF ]

with Yichun Chi and Sheldon X. Lin. Insurance: Mathematics and

Economics.46(1), pg. 52-66.

In this paper, we extend the Cramer-Lundberg insurance risk

model perturbed by diffusion to incorporate stochastic volatility and study the

resulting Gerber-Shiu expected discounted penalty(EDP) function. Under the

assumption that volatility is driven by an underlying Ornstein-Uhlenbeck (OU)

process, we derive the integro-differential equation which the EDP function

satisfies. Not surprisingly, no closed-form solution exists; however, assuming

the driving OU process is fast mean-reverting, we apply singular perturbation

theory to obtain an asymptotic expansion of the solution. Two

integro-differential equations for the first two terms in this expansion are

obtained and explicitly solved. When the claim size distribution is of

phase-type, the asymptotic results simplify even further and we succeed in

estimating the error of the approximation. Hyper-exponential and mixed-Erlang

distributed claims are considered in some detail.

Levy Based Cross-Commodity Models and Derivative

Valuation [ PDF ][ Matlab ] with Vladimir Surkov.

SIAM Journal on Financial Mathematics (2) pp.464-487

Energy commodities, such as oil, gas and electricity, lack

the liquidity of equity markets, have large costs associated with storage,

exhibit high volatilities and can have significant spikes in prices.

Furthermore, and possibly most importantly, commodities tend to revert to long

run equilibrium prices. Many complex commodity contingent claims exist in the

markets, such as swing and interruptible options; however, the current method

of valuation relies heavily on Monte Carlo simulations and tree based methods.

In this article, we develop a new framework for dealing with mean-reverting

jump-diffusion (and pure jump) models by working in Fourier space. The method

is based on the Fourier space time stepping algorithm of Jackson, Jaimungal,

and Surkov (2008), but is tailored for mean-reverting models. We demonstrate

the utility of the method by applying it to the valuation of European, American

and barrier options on a single underlier, European and Bermudan spread options

on two-dimensional underliers, and swing options.

Stepping Through Fourier Space [ PDF ][ Matlab ] with Vladimir Surkov.

Risk, July, 2009, p78-83.

Diverse finite-difference schemes for solving pricing

problems with Levy underliers have been used in the literature. Invariably, the

integral and diffusive terms are treated asymmetrically, large jumps are

truncated, the methods are difficult to extend to higher dimensions and cannot

easily incorporate regime switching or stochastic volatility. We present a new

efficient approach which switches between Fourier and real space as time

propagates backwards. We dub this method Fourier Space Time-Stepping (FST). The

FST method applies to regime switching Levy models and is applicable to a wide

class of path-dependent options (such as Bermudan, barrier, shout and

catastrophe linked options) and options on multiple assets.

Fourier Space Time Stepping for Option Pricing with

Levy Models [ PDF ][

Matlab ] with Kenneth R.

Jackson and Vladimir Surkov. Journal of Computational Finance, Vol 12

Issue 2, p1-29.

Jump-diffusion and Levy models have been widely used to

partially alleviate some of the biases inherent in the classical

Black-Scholes-Merton model. Unfortunately, the resulting pricing problem

requires solving a more difficult partial-integro differential equation (PIDE)

and although several approaches for solving the PIDE have been suggested in the

literature, none are entirely satisfactory. All treat the integral and

diffusive terms asymmetrically, truncate large jumps and are difficult to

extend to higher dimensions. We present a new, efficient algorithm, based on

transform methods, which symmetrically treats the diffusive and integrals

terms, is applicable to a wide class of path-dependent options (such as

Bermudan, barrier, and shout options) and options on multiple assets, and

naturally extends to regime-switching Levy models. We present a concise study

of the precision and convergence properties of our algorithm for several

classes of options and Levy models and demonstrate that the algorithm is

second-order in space and first-order in time for path-dependent options.

Asymptotic Pricing of Commodity Derivatives for

Stochastic Volatility Spot Models [ PDF

] with Samuel Hikspoors. Applied Mathematical Finance, vol 15 Issue

5&6, p449-447.

It is well known that stochastic volatility is an essential

feature of commodity spot prices. By using methods of singular perturbation

theory, we obtain approximate but explicit closed form pricing equations for

forward contracts and options on single- and two-name forward prices. The

expansion methodology is based on a fast mean-reverting stochastic volatility

driving factor, and leads to pricing results in terms of constant volatility

prices, their Delta's and their Delta-Gamma's. The stochastic volatility

corrections lead to efficient calibration and sensitivity calculations.

Consistent Functional PCA for Financial

Time-Series [ PDF ]

with Eddie. K. H. Ng, Proceedings of the 4th IASTED International

Conference on Financial Engineering and Applications.

Functional Principal Component Analysis (FPCA) provides a

powerful and natural way to model functional financial data sets (such as

collections of time-indexed futures and interest rate yield curves). However,

FPCA assumes each sample curve is drawn from an independent and identical

distribution. This assumption is axiomatically inconsistent with financial

data; rather, samples are often interlinked by an underlying temporal dynamical

process. We present a new modeling approach using Vector auto-regression (VAR)

to drive the weights of the principal components. In this novel process, the

temporal dynamics are first learned and then the principal components

extracted. We dub this method the VAR-FPCA. We apply our method to the NYMEX

light sweet crude oil futures curves and demonstrate that it contains

significant advantages over the conventional FPCA in applications such as

statistical arbitrage and risk management.

Option Pricing with Regime Switching Levy processes

using Fourier Space Time Stepping [ PDF

] with Kenneth R. Jackson and Vladimir Surkov, Proceedings of the 4th

IASTED International Conference on Financial Engineering and Applications.

Although jump-diffusion and L´evy models have been widely

used in industry, the resulting pricing partial-integro differential equations

poses various difficulties for valuation. Diverse finite-difference schemes for

solving the problem have been introduced in the literature. Invariably, the

integral and diffusive terms are treated asymmetrically, large jumps are

truncated and the methods are difficult to extend to higher dimensions. We

present a new efficient transform approach for regime-switching L´evy models

which is applicable to a wide class of path-dependent options (such as

Bermudan, barrier, and shout options) and options on multiple assets.

Energy Spot Price Models and Spread Options

Pricing[ PDF

] with Samuel Hikspoors, International Journal of Theoretical and Applied

Finance, vol 10(7), pg. 1111-1135.

In this article, we construct forward price curves and value a class of two

asset exchange options for energy commodities. We model the spot prices using

an affine two-factor mean-reverting process with and without jumps. Within this

modeling framework, we obtain closed form results for the forward prices in

terms of elementary functions. Through measure changes induced by the forward

price process, we further obtain closed form pricing equations for spread

options on the forward prices. For completeness, we address both an Actuarial

and a risk-neutral approach to the valuation problem. Finally, we provide a

calibration procedure and calibrate our model to the NYMEX Light Sweet Crude

Oil spot and futures data, allowing us to extract the implied market prices of

risk for this commodity.

Catastrophe options with stochastic interest rates

and compound Poisson losses[ PDF

] with Tao Wang, Insurance Mathematics and Economics (2006) vol 38 (3)

469-483

We analyze the pricing and hedging of catastrophe put options under

stochastic interest rates with losses generated by a compound Poisson process.

Asset prices are modeled through a jump-diffusion process which is correlated

to the loss process. We obtain explicit closed form formulae for the price of

the option, and the hedging parameters Delta, Gamma and Rho. The effects of

stochastic interest rates and variance of the loss process on the options price

are illustrated through numerical experiments. Furthermore, we carry out a

simulation analysis to hedge a short position in the catastrophe put option by

using a DeltaGammaRho neutral self-financing portfolio. We find that accounting

for stochastic interest rates, through Rho hedging, can significantly reduce

the expected conditional loss of the hedged portfolio.

Pricing Equity Linked Pure Endowments with Risky

Assets that follow Levy Processes.[ PDF

] with Virginia Young, Insurance Mathematics and Economics (2005) vol 36

(3) 329-346

We investigate the pricing problem for pure endowment contracts whose life

contingent payment is linked to the performance of a tradable risky asset or

index. The heavy tailed nature of asset return distributions is incorporated

into the problem by modeling the price process of the risky asset as a finite

variation Levy process. We price the contract through the principle of

equivalent utility. Under the assumption of exponential utility, we determine

the optimal investment strategy and show that the indifference price solves a

non-linear partial-integro-differential equation (PIDE). We solve the PIDE in

the limit of zero risk aversion, and obtain the unique risk-neutral equivalent

martingale measure dictated by indifference pricing. In addition, through an

explicit–implicit finite difference discretization of the PIDE we numerically

explore the effects of the jump activity rate, jump sizes and jump skewness on

the pricing and the hedging of these contracts.

A Two-State Jump Model [ PDF ] with

Claudio Albanese and Dmitri .H. Rubisov, Quantitative Finance (2003) vol

3(2) 145-154

We introduce a pricing model for equity options in which sample paths follow

a variance-gamma (VG) jump model whose parameters evolve according to a

two-state Markov chain process. As in GARCH type models, jump sizes are

positively correlated to volatility. The model is capable of justifying the

observed implied volatility skews for options at all maturities. Furthermore,

the term structure of implied VG kurtosis is an increasing function of the time

to maturity, in agreement with empirical evidence. Explicit pricing formulae,

extending the known VG formulae, for European options are derived. In addition,

a resummation algorithm, based on the method of lines, which greatly reduces

the algorithmic complexity of the pricing formulae, is introduced. This

algorithm is also the basis of approximate numerical schemes for American and

Bermudan options, for which a state dependent exercise boundary can be

computed.

Jumping In Line [ PDF ]

with Claudio Albanese and Dmitri .H. Rubisov, RISK, Feb. issue, pg.

65-70

The variance gamma jump model is known to describe the volatility smile for

shortdatedoptions accurately. However, implementation for exotic path-dependent

optionscan prove difficult. Here, Claudio Albanese, Sebastian Jaimungal and

Dmitri Rubisov usethe method of lines to develop an alternative approach,

allowing prices to be calculatedin a more straightforward manner, either

analytically or through numerical integration